Zcash's Price Surge: The Reddit Hype vs. The Cold Hard Reality

Well, look what the cat dragged in. Zcash. Just when you thought the crypto market had run out of dusty relics to pump, the mob rediscovers the ghost of 2018. Suddenly, my feed is flooded with charts of ZEC going vertical, and a bunch of newly minted "privacy experts" are screaming about financial sovereignty. Give me a break.

The Zcash price is ripping, soaring over 40% in a day and turning over a billion dollars in volume. We're seeing similar, frankly absurd, pumps in other so-called privacy coins like Dash and Railgun. Everyone is acting like this is some kind of grassroots revolution, a righteous stand against the surveillance state. It’s not.

Let's be brutally honest about what this is. It’s a classic narrative play. No, ‘classic’ is too kind. It’s a rerun. Capital gets bored. Bitcoin hits a new high, cools off, and a legion of traders with itchy trigger fingers start looking for the next shiny object. They rummage through the crypto industry's garage and pull out the "privacy" box, blow the dust off, and pretend it's brand new. It ain't.

This whole thing feels like a well-coordinated stage play. The script is almost insultingly predictable. Are we really supposed to believe that after years of bleeding out against Bitcoin, ZEC suddenly woke up and chose violence all on its own?

The Holy Trinity of Hype

So what’s fueling this rocket ship? The cheerleaders will point to a few convenient catalysts that, if you squint hard enough, almost look legitimate. The question on everyone's mind is, Why is Zcash (ZEC) Price Going up Today?

First, you have the institutional "access" narrative. Grayscale, the king of crypto wrappers for the Wall Street crowd, has a ZEC trust. This has ignited hopes—or should I say, pure, uncut hopium—that a Zcash ETF is next. It's the perfect story. It makes retail traders feel like they're getting in before the "smart money" arrives. But what does a trust really mean? It means Grayscale found a way to charge a fee. Is there any concrete evidence of an ETF filing or genuine, new institutional demand? Offcourse not, but why let facts get in the way of a good pump?

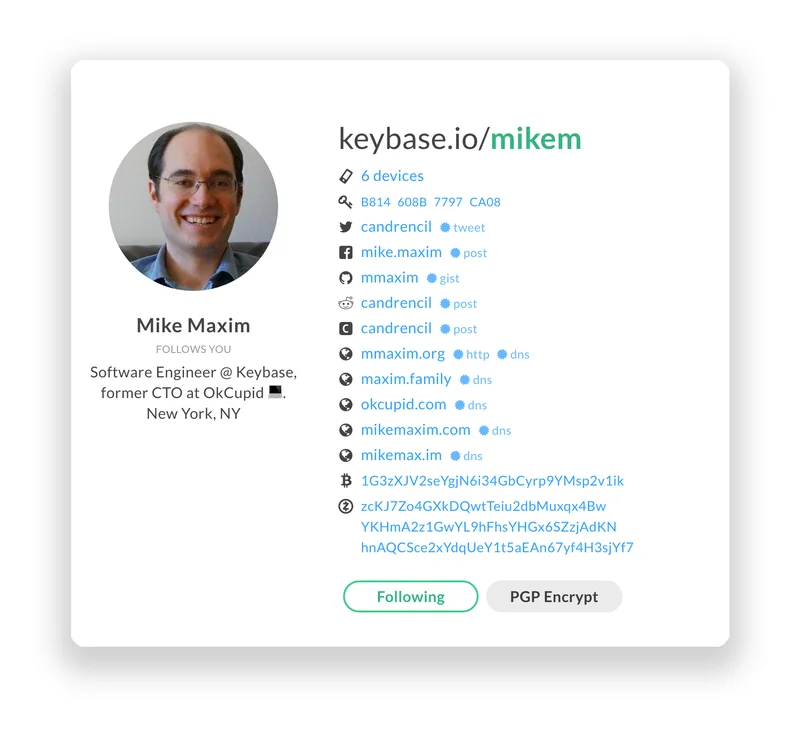

Then comes the influencer brigade. Venture capitalist Naval Ravikant calls Zcash "insurance against Bitcoin." Other big-name accounts are suddenly singing its praises. It’s a beautiful, self-reinforcing loop. The price moves a little, the influencers notice and amplify it, their followers pile in, and the price moves a lot. This isn't organic demand; it's marketing. It’s like watching a DJ at a wedding realize the crowd is dead and deciding to play "Don't Stop Believin'." It’s a cheap, guaranteed trick to get people on the dance floor, but it’s not exactly groundbreaking artistry. Is anyone asking why these influencers are suddenly so bullish now, after years of silence? What's in it for them?

Finally, there’s the macro-narrative of a renewed demand for privacy. With governments everywhere talking about CBDCs and stricter financial controls, the pitch for privacy-focused crypto writes itself. Thor Torrens, a Zcash adviser, says "surveillance and censorship are increasing." He's not wrong, but using that very real fear to pump a token that’s still 92% down from its all-time high feels… cynical. It’s preying on legitimate anxiety to fuel a speculative frenzy. And honestly, it’s just lazy. Every time a regulator sneezes, someone screams "buy Monero!" or "Zcash is the answer!" It’s the crypto equivalent of blaming everything on the weather.

Don't Be the Exit Liquidity

Here's the part nobody wants to hear while they're watching green candles. This has happened before, and it rarely ends well for the people who show up late. There's an old trader heuristic that a massive ZEC pump can signal a local top for Bitcoin and the broader market. It's the "canary in the coal mine" trade—a final, desperate gasp for gains in a forgotten corner of the market before liquidity dries up.

I’m not saying it’s a rule, but history rhymes. We're seeing capital rotate out of majors and into high-beta, high-risk plays. It's a sign of froth, not strength. Everyone feels like a genius in a market like this, but when the music stops, someone is always left holding the bag.

The technology behind Zcash, the zk-SNARKs, is genuinely cool. I'll give them that. But a cool piece of tech and a good investment are two very different things. Right now, the Zcash crypto price isn't being driven by fundamentals or adoption. It's being driven by a story, a meme, a collective daydream.

And what happens when the market finds a new story next week? When the narrative shifts to, I don't know, decentralized dog walking apps or something equally absurd? The hot money will vanish as quickly as it appeared, leaving a trail of wrecked accounts in its wake. It’s the endless, exhausting cycle of this market, and it drives me nuts. Every time you think things are maturing, you get a flashback to 2017, and we all know how that ends—

So, by all means, watch the show. Enjoy the fireworks. But don't mistake a short-squeeze fueled by recycled narratives for a revolution. Don't get played.

Same Circus, Different Clowns

Let's cut the crap. This isn't a privacy renaissance. It's a casino, and the house just opened the Zcash table because the Bitcoin and Ethereum tables were getting a little too crowded. The narratives are just the fancy cocktails they serve to make you feel sophisticated while you're gambling. The Grayscale "news," the influencer endorsements—it's all just noise designed to create FOMO. If you're buying ZEC at these prices, you're not an investor; you're the exit liquidity for people who got in weeks ago. Don't be a sucker.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Token Performance & Investor Trends Post-October Crash: what they won't tell you about investors and the bleak 2025 ahead

- Render: What it *really* is, the tech-bro hype, and that token's dubious 'value'

- APLD Stock: What's *Actually* Fueling This "Big Move"?

- Avici: The Real Meaning, Those Songs, and the 'Hell' We Ignore

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Starknet: What it is, its tokenomics, and current valuation

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)