Binance Faces Indian Tax Probe: What We Know About the Trader Investigation

The Honeypot and the Taxman: How Binance's Return to India Became a Trap

The news reads like a standard regulatory crackdown: Indian tax authority targets over 400 wealthy Binance traders in tax evasion probe: report. On the surface, it’s a simple story of a government enforcing its laws. But that’s a superficial reading of the data. The real story here isn’t about a few hundred traders who may have failed to file correctly. It’s about the inevitable, mathematical outcome of a calculated business decision made by the world's largest crypto exchange.

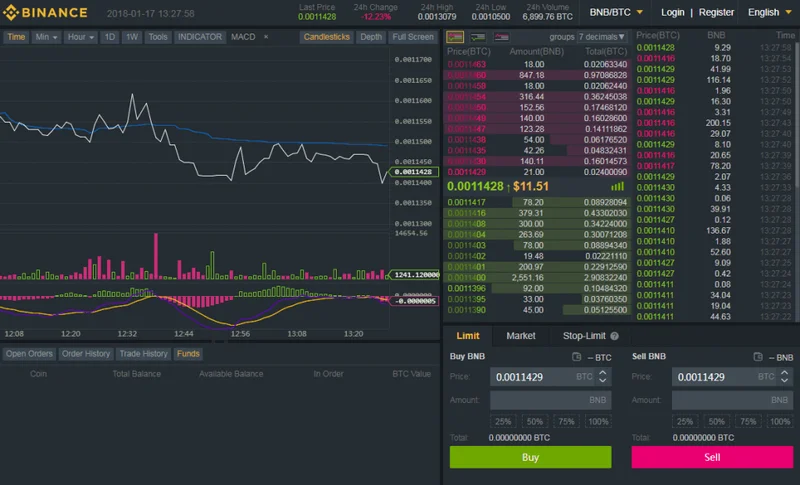

Binance's re-entry into the Indian market in August 2024 wasn't a triumph; it was a transaction. The exchange paid a penalty of around $2.2 million—$2.25 million, to be exact—to settle accusations of operating illegally. But the monetary cost was trivial. The real price of admission was registering as a "reporting entity" with India's Financial Intelligence Unit (FIU). This single, seemingly bureaucratic step fundamentally altered the risk calculus for every one of its Indian users. It effectively turned the exchange from a perceived offshore haven into a domestic surveillance partner.

This investigation, targeting trades from 2022 to 2025, was not just made possible by this registration; it was the entire point of it. Imagine a tax official’s office, late at night, the only light coming from a monitor displaying rows of freshly acquired data. The quiet hum of the server is the sound of a regulatory net being drawn tight. For years, the Indian government watched capital flow through these platforms with limited visibility. Now, the floodgates of information are open. This isn't a random audit. This is the first, predictable harvest from a field Binance itself was forced to plow.

The incentive for evasion was, and remains, enormous. India’s crypto tax regime is one of the world's most aggressive. It includes a 1% tax deducted at source (TDS) on all transfers, plus a flat 30% tax on profits. When you add the applicable surcharge and a 4% cess, the top-bracket effective rate climbs precipitously. The tax on profits is 30% (which rises to an effective rate near 42.7% for the highest earners). With such punitive rates, the temptation to use an international exchange to remain opaque is understandable from a purely financial perspective. But what happens when that shield of opacity is removed?

A Conditional Surrender

Binance’s decision to comply and register with the FIU is a fascinating case study in corporate strategy. The exchange was blocked in late 2023, effectively cutting it off from a market of 1.4 billion people. The choice was stark: remain an outlaw with zero access or pay a fine, submit to local rules, and regain entry. From a revenue standpoint, the choice was obvious. The long-term value of the Indian market far outweighs the penalty and the compliance costs.

This is the part of the analysis that I find genuinely puzzling from the perspective of the traders being investigated. Did they not see this coming? The moment Binance announced its intention to re-register, the game changed. Continuing to trade under the assumption of privacy was a catastrophic miscalculation. It’s akin to continuing to whisper secrets in a room after you’ve watched the other party install microphones on every wall. The exchange’s re-registration wasn’t a peace treaty; it was a conditional surrender, and the primary condition was handing over the ledger.

The probe’s scope further underscores this new reality. Authorities aren't just looking at crypto-to-crypto trades. They are specifically examining peer-to-peer (P2P) transactions settled using domestic bank accounts, Google Pay, and even cash. This demonstrates a sophisticated understanding of how value actually moves. The on-chain data is one piece of the puzzle; the off-ramp is the other. By compelling Binance to provide its records, the government can now correlate on-platform activity with real-world financial movements.

This raises a critical, unanswered question: what is the precise nature of the data being shared? Is it a complete, retroactive data dump of all user activity, or is it targeted information provided upon request? The report suggests the registration "paved the way" for this, but the mechanics of that information sharing remain opaque. Is Binance proactively flagging suspicious accounts, or is it simply responding to a government subpoena for a list of its largest Indian traders? The distinction is crucial for understanding the level of cooperation involved.

The Data Always Wins

Ultimately, this entire episode is a lesson in the power of centralized data. The promise of cryptocurrency was decentralization and sovereignty, but the reality for most users is that they interact with the ecosystem through centralized choke points—the exchanges. And those choke points are, and always will be, vulnerable to state-level pressure.

This isn't just an Indian story. It is a template. Governments globally are realizing they don't need to "break" crypto's encryption or outlaw it entirely. They just need to regulate the on-ramps and off-ramps. By forcing major exchanges like Binance to register as reporting entities, they convert private corporations into extensions of their own tax and intelligence agencies. The $2.25 million fine wasn't punishment; it was an acquisition cost. For that price, the Indian government acquired a firehose of financial data.

The 400 traders now under investigation are simply the first consequence of this new paradigm. They bet on regulatory arbitrage and lost. Their mistake was believing their chosen platform was a sovereign entity, when in fact, it was just a business that, like any other, will ultimately comply with the law of the land to protect its market share. The ledger, for all intents and purposes, is now public.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Token Performance & Investor Trends Post-October Crash: what they won't tell you about investors and the bleak 2025 ahead

- Render: What it *really* is, the tech-bro hype, and that token's dubious 'value'

- APLD Stock: What's *Actually* Fueling This "Big Move"?

- Avici: The Real Meaning, Those Songs, and the 'Hell' We Ignore

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Starknet: What it is, its tokenomics, and current valuation

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)