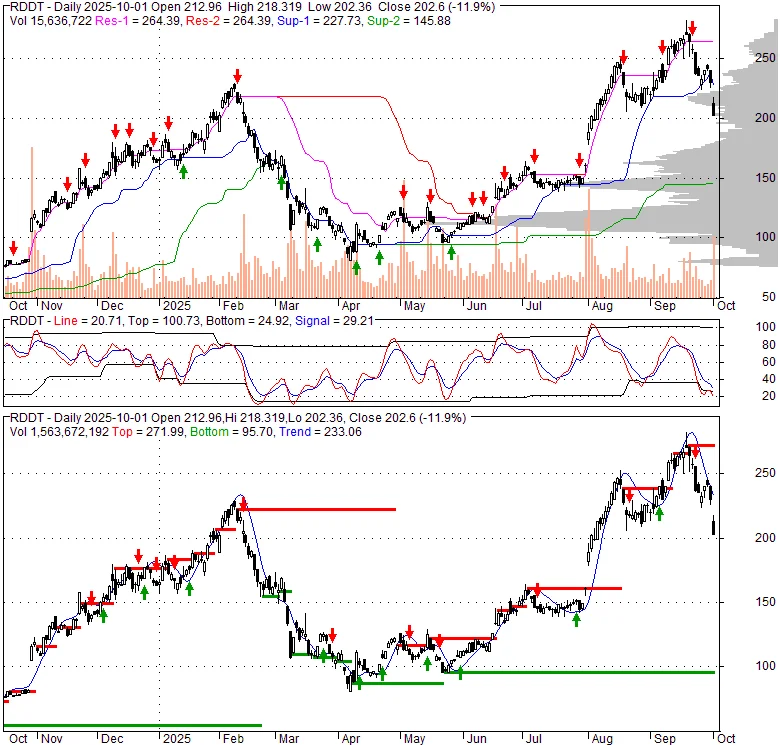

Reddit's Stock (RDDT): A Sober Look at the Price Action and Market Comparisons

The market narrative surrounding Reddit (RDDT) has been, to put it mildly, euphoric. Since its March 2024 IPO, the stock has delivered a staggering return, surging over 600%. The company’s Q2 2025 earnings report read like a growth investor’s wish list: revenue accelerated 78% year-over-year to $500 million, crushing estimates. Advertising revenue alone jumped 84%. The company didn’t just grow; it became profitable, posting $89 million in net income against a loss in the prior year. Gross margins sit at a remarkable 90.8%, a figure that would make most software executives envious.

This performance is underpinned by two powerful stories. First, the core advertising business is finally scaling. Daily Active Uniques (DAUs) grew a healthy 21% to 110 million, but the crucial metric, Advertising Revenue Per User (ARPU), exploded by 47%. This suggests Reddit is getting dramatically better at monetizing the attention it has long held captive. Second, and perhaps more compellingly for the current market, is the AI data licensing angle. With deals worth a combined $130 million already inked with Google and OpenAI in the first half of 2025, management is projecting a potential $300 million annual revenue stream from this new, high-margin business. CEO Steve Huffman’s declaration that “Reddit is built for this moment” in an era of AI feels less like marketing and more like a statement of fact.

The result is a stock that has become a momentum favorite, often mentioned in the same breath as high-flyers like NVDA or Palantir (PLTR). Wall Street has largely bought in, with firms like JMP Securities and Needham slapping $300 price targets on the name. The story is clean, the numbers are strong, and the tailwinds seem undeniable.

The Valuation Says ‘Buy,’ The C-Suite Says ‘Sell’

A Discrepancy in the Data

And this is the part of the report where my analysis hits a significant discrepancy. When a company’s public-facing data is this pristine, the valuation tends to reflect it. Reddit is no exception. It trades at a price-to-sales multiple of around 24x and a trailing P/E of over 200x. These are not just premium multiples; they are multiples that price in years of flawless execution and uninterrupted hyper-growth. For context, this is significantly richer than peers like Snap, and it implies a level of certainty about the future that rarely exists.

When I see a valuation this stretched, I start looking for countervailing data points. I look for information that isn't in the glossy earnings presentation. In the case of Reddit, that data is unambiguous, and frankly, it’s alarming. While institutional investors and retail traders have been bidding the stock up, Reddit’s own executive team has been selling. And not just selling, but liquidating shares on a scale that is impossible to ignore.

Over the past six months, corporate insiders have executed 302 open-market sales of RDDT stock. During that same period, they have made exactly zero purchases.

Let’s be precise. CEO and President Steve Huffman has sold 493,225 shares for an estimated $64 million. Chief Operating Officer Jennifer Wong has sold 276,694 shares for nearly $50 million. The Chief Technology Officer, Chief Financial Officer, Chief Accounting Officer, and Chief Legal Officer have all sold millions of dollars’ worth of stock. This isn't one executive diversifying a concentrated position. This is a coordinated, top-to-bottom exodus of equity by the very people with the most intimate knowledge of the company’s operations and forward-looking trajectory. I've looked at hundreds of these filings, and this particular pattern—a complete absence of buying coupled with systematic selling across the entire C-suite so soon after a blockbuster IPO—is an unusually potent red flag.

The bull case requires you to believe that the executives steering the ship have collectively decided to offload more than $150 million in stock (based on available estimates) for reasons entirely unrelated to their assessment of the company’s future value, right as its growth is supposedly hitting an inflection point. That is a difficult assumption to make.

This insider activity provides a crucial context for the anecdotal, qualitative data bubbling up in market forums and on platforms like X. Chatter about declining user engagement and the possibility of AI models becoming less reliant on Reddit’s data is, by itself, just noise. But when viewed alongside the insider "signal," it forms a coherent, alternative hypothesis: that the spectacular growth seen in the first half of 2025 may not be sustainable at its current rate. The people with the best view of the internal dashboards are taking their chips off the table.

Publicly, analysts remain bullish, with a consensus "Moderate Buy" rating. But a closer look reveals a crack in the optimism. The median 12-month price target from 23 analysts is around $200. As of the end of September, RDDT stock price was trading near $230. It’s a rare situation where the consensus rating is a “buy,” but the consensus price target is already in the rearview mirror. Baird’s recent target bump to $240 came with a "Neutral" rating, a tacit acknowledgment that the risk/reward is no longer compelling. It seems the quantitative models of Wall Street are beginning to diverge from the bullish narrative.

The market has priced Reddit as if its victory is assured, a dominant force akin to Google (GOOG stock) in search or Tesla (TSLA stock) in the early EV boom. The financial reports from Q1 and Q2 support that thesis. But the actions of its leadership suggest a profound lack of conviction in that same story. When presented with two conflicting datasets, an investor must decide which one carries more weight: the polished, public-facing numbers, or the quiet, personal financial decisions of those on the inside.

*

The Signal and the Noise

The quarterly earnings reports are the noise—a backward-looking snapshot of a phenomenal run. The insider transaction ledger is the signal. It is a forward-looking indicator of confidence, and right now, it is blinking bright red. The asymmetry of information lies with the executive team, and their actions suggest the current valuation leaves no room for error. The market is buying the story; the people writing the story are selling the stock.

Reference article source:

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Token Performance & Investor Trends Post-October Crash: what they won't tell you about investors and the bleak 2025 ahead

- Render: What it *really* is, the tech-bro hype, and that token's dubious 'value'

- APLD Stock: What's *Actually* Fueling This "Big Move"?

- Avici: The Real Meaning, Those Songs, and the 'Hell' We Ignore

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Starknet: What it is, its tokenomics, and current valuation

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)