The SMR Stock Gold Rush: What's Behind the Army Deal Hype and Is It All Just Hot Air?

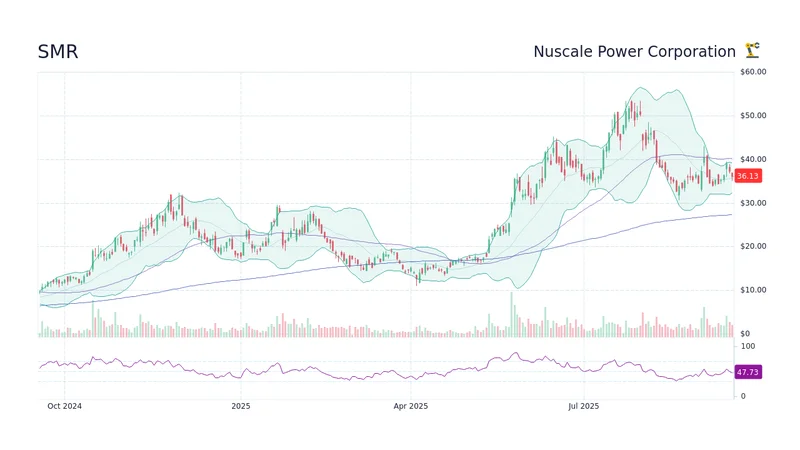

So, the U.S. Army wants to slap a mini nuclear reactor on every forward-deployed base on the planet. And because of this, a company called NuScale Power, ticker SMR, saw its stock price go completely bananas. It shot up over 20% in a single morning.

Let's all take a deep breath.

The announcement came from the top brass at some conference in D.C., a place where good ideas and taxpayer money go to die. The Army is launching the "Janus Program" to build and test these little reactors, a move that had Nuclear stocks mixed after U.S. Army launches program to deploy small reactors. The magic words that sent Wall Street into a frenzy? The reactors will be "commermercially owned and operated."

And who has the only small modular reactor (SMR) design actually approved by the U.S. Nuclear Regulatory Commission? You guessed it. NuScale. It’s a perfect story. A match made in heaven. The military-industrial complex finds its new favorite toy, and a publicly-traded company is positioned to print money. The stock, which IPO'd at $10 a few years back, is now flirting with $50.

It's a beautiful narrative. Almost too beautiful.

The Greatest Movie Trailer Ever Made

Right now, investing in NuScale feels like buying a ticket for a movie based solely on an amazing trailer. The trailer is spectacular. You've got thrilling shots of futuristic, clean energy. You've got the U.S. Army as the heroic co-star. You've got soundbites about powering AI data centers and securing the nation's future. It’s got everything.

But we've all been burned by amazing trailers for terrible movies, haven't we?

The "movie" here is NuScale actually building these things on time and on budget. And their track record is... well, it’s complicated. Remember their big project in Idaho? The one they were supposed to build to prove the concept? It got canceled in 2023. Why? Because the projected costs nearly doubled. Doubled. This isn't a kitchen remodel going a little over budget; this is the fundamental economics of the business model imploding on the launchpad.

And what about all this talk of powering the AI revolution? CEO John Hopkins himself admitted on an earnings call that NuScale hasn't actually signed a single U.S. data-center customer yet. It’s all talk. Potential. Hype.

So while everyone is mesmerized by the trailer, I can’t help but wonder if the actual film is going to be a low-budget flop. Are we supposed to believe that just because the Army is involved, the laws of physics and economics suddenly don't apply? What happens when the first SMR built for Uncle Sam goes 2x over budget? Who eats that cost? I’ll give you a hint: it probably won’t be the generals or the company executives.

While You Were Buying, They Were Selling

Here’s the part of the story that the breathless headlines seem to conveniently ignore. While retail investors are piling into SMR stock, chasing the Army contract dream, the people who know the company best are quietly heading for the exits.

Fluor Corp, NuScale’s majority owner and parent company, just dumped 15 million shares for a cool $605 million. Let me repeat that. The company that literally created NuScale just cashed out over half a billion dollars worth of stock. A Fluor director also sold off nearly 20% of his personal stake for over $100 million a month earlier.

This is a bad look. No, 'bad' doesn't cover it—this is a five-alarm fire drill in the C-suite.

Why, if you were on the verge of landing the most lucrative government contracts imaginable and cornering the market on next-gen nuclear, would you be selling? You wouldn't. You'd be backing up the truck and buying more. The only reason to sell at this scale is if you think the stock price has gotten way ahead of itself. If you think this is the peak of the hype cycle, and it’s time to take your winnings off the table before reality sets in.

It's the oldest story on Wall Street. The insiders and the smart money create a compelling story, pump it to the moon, and then sell their shares to the suckers who show up late to the party. The market is a forward-looking mechanism, they say. Offcourse, it is. It's looking forward to finding a greater fool to hold the bag.

The analysts can’t even agree on what this thing is worth. Price targets are all over the map, from $28 to $60. The consensus rating is a lukewarm "Hold." That's Wall Street code for "We have no earthly idea, but we don't want to miss out if this thing actually works." It ain't exactly a ringing endorsement.

Then again, maybe I'm the crazy one. Maybe this time is different. Maybe a company with a history of massive cost overruns and a boardroom full of sellers is actually the safest bet on the planet because the government said so. And maybe I have a bridge in Brooklyn to sell you...

Follow the Money, Not the Hype

Look, I get the appeal. Clean, reliable, carbon-free energy is the holy grail. SMRs sound like a brilliant solution. But an idea, even a brilliant one, isn't a business. A business is about execution, and NuScale has yet to prove it can execute at scale without budgets spiraling into oblivion. The Army's interest is a massive vote of confidence, but it's not a signed contract, and it doesn't erase the company's history. When the people who know the most are selling, and the people who know the least are buying, you don't need a PhD in finance to figure out which side of the trade you should be on.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi Token Performance & Investor Trends Post-October Crash: what they won't tell you about investors and the bleak 2025 ahead

- Render: What it *really* is, the tech-bro hype, and that token's dubious 'value'

- APLD Stock: What's *Actually* Fueling This "Big Move"?

- Avici: The Real Meaning, Those Songs, and the 'Hell' We Ignore

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Starknet: What it is, its tokenomics, and current valuation

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)