Ripple's XRP: Is the Bull Run Over and What's This SWIFT Drama?

So, you survived the great XRP flush. Congratulations. Waking up to see your portfolio take a 40% nosedive is a rite of passage in crypto, a baptism by fire that leaves you either numb or a true believer. The xrp price went from a glorious new all-time high of $3.65 this summer—finally breaking a record that stood for eight long years—to getting absolutely curb-stomped down to under $1.50.

It’s recovered a bit, clawing its way back to the $2-something range, but the damage is done. The confidence is shot. While Bitcoin was hitting new peaks and coins like BNB were doing a moonshot, XRP was getting demoted to fifth place, a situation that has many asking: Ripple Is Down to 5th: Is XRP’s Bull Run Officially Over? It feels like getting lapped in a race you were supposed to be winning.

And now, everyone’s looking for answers, for some sign that this isn’t the end. They're looking for news, any ripple xrp news, that can justify holding on. Well, the news is here. But I’m not sure you’re going to like it.

The Dinosaur Learns a New Trick

Just as Ripple’s blood was in the water, the old king of the financial jungle, SWIFT, decided to make its move. You know SWIFT—the 1970s-era messaging system that banks use to slowly and expensively shuffle money around the globe. It's the financial equivalent of a fax machine in an age of instant messaging. Now, suddenly, they’ve announced a "blockchain ledger" project.

Give me a break.

While some headlines proclaim the XRP Price Hangs by a Thread as SWIFT Bets on Blockchain to Catch Ripple in Its Own Game, this is like watching a dinosaur suddenly decide it wants to grow feathers and fly. SWIFT, the institution that Ripple was built to replace, is now claiming it can beat Ripple at its own game. They’re partnering with Consensys to build a system for tokenized assets and real-time settlement, aiming to make their network of 11,000 banks feel modern again. It’s a desperate PR move, a fresh coat of "blockchain" paint on a crumbling, ancient building.

Their big selling point? Interoperability and using their existing network. They're telling the banks, "Don't worry, you won't have to change a thing! Just plug into our new, shiny blockchain thingy." This is a classic incumbent move. It’s not about innovation; it’s about preservation. They want to keep their throne, and they’ll slap whatever buzzwords are necessary onto their marketing materials to do it. But can a 50-year-old bureaucracy really compete with a technology built from the ground up for speed and efficiency? Or is this just a multi-billion dollar project to reinvent the wheel, only this time make it square?

Meanwhile, Ripple already has giants like SBI Remit in Japan and Pyypl in the Middle East using XRP for actual, real-world cross-border payments. They’re not running a pilot program; they’re moving money. The ripple xrp swift showdown is being framed as a clash of titans, but right now, it looks more like a speedboat racing against a cargo ship that's just realized the race started an hour ago.

Praying at the Altar of the ETF

With the competitive landscape looking messy and the charts looking grim, the "XRP Army" has pinned all its hopes on one last savior: a spot XRP ETF in the United States. The hype is palpable. Polymarket is giving it a 99% chance of approval before the end of the year. Everyone is convinced that once Wall Street can package and sell XRP to the masses, the floodgates of institutional money will open and wash away all our sorrows.

This is a terrible idea. No, "terrible" doesn't cover it—this is textbook delusion.

First off, let’s talk about the real world. The US government has been shut down for over a week. You expect the SEC, an agency that moves at a glacial pace on a good day, to approve a revolutionary financial product while they can’t even agree to keep the lights on? It’s absurd. This is the kind of bureaucratic sludge that crypto was supposed to make obsolete, yet here we are, hanging on every word from a paralyzed government agency. It’s almost funny. Almost.

Second, and this is the part nobody wants to hear: it’s already priced in. When a bet has 99% odds, the smart money has already made its move. The pump you’re hoping for probably already happened on the rumor. The real event, the "news," is when the latecomers get to be the exit liquidity for the early birds. What happens if the ETF launches and the inflows are just… okay? What if it’s a trickle, not a flood? The resulting crash in confidence would be far worse than the one we just had.

And offcourse, the market doesn't care about your hopes and dreams. It only cares about momentum, and right now, the momentum has left XRP for shinier toys. Investors are rotating into whatever’s moving, and XRP is sitting there, wounded, waiting for a miracle from regulators who... well, who frankly have bigger problems on their hands.

So, Who's Getting Played Here?

Let's be brutally honest. You have an ancient banking network desperately trying to stay relevant by co-opting the language of its disruptor. On the other side, you have a digital asset whose community is banking on a government approval that’s both delayed and likely already baked into the ripple xrp price. It feels less like a financial revolution and more like two different sides of the same coin, both promising a future that may never arrive. One is selling stability that feels like stagnation, the other is selling hope that feels a lot like a gamble. And in the middle of it all are regular people just hoping they bet on the right horse. Good luck with that.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

-

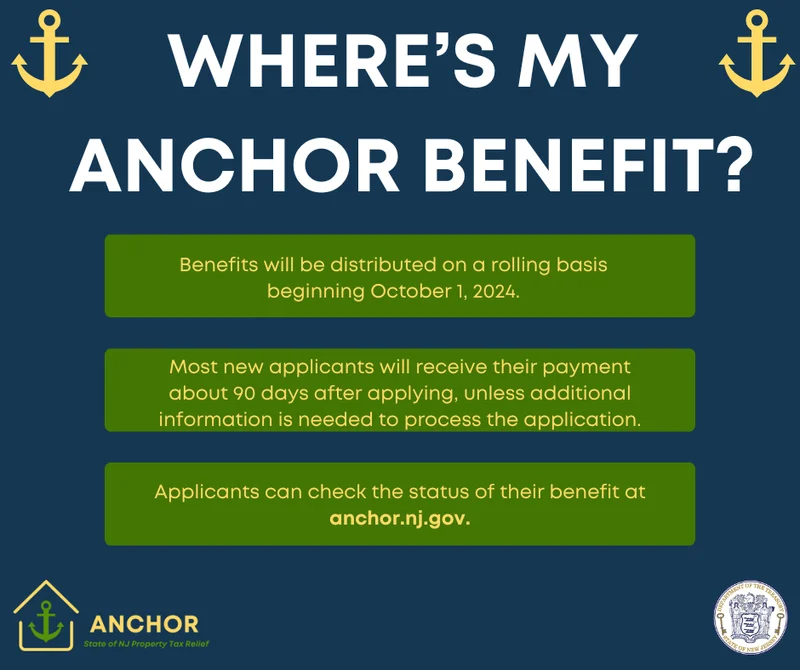

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

- Search

- Recently Published

-

- The Fight for Solar Incentives: What's Really at Stake and Why It's Our Biggest Opportunity Yet

- Scott Bessent's 'Price Floor' Plan for China: What We Know and Why It's Pure Insanity

- Salesforce (CRM) Stock Surges on $60B Revenue Target: What the Forecast Means and If the Numbers Add Up

- The SMR Stock Gold Rush: What's Behind the Army Deal Hype and Is It All Just Hot Air?

- United Airlines Stock Drops on Mixed Q3 Results: Analyzing the Earnings Beat and Revenue Shortfall

- COOT Stock's Breakthrough Surge: Why It's Happening and What It Means for Our Future

- Tech Giants' $40B Aligned Data Centers Acquisition: Why This Is a Turning Point for AI's Future

- Turkey's "Steel Dome" Defense System: What It Is and Why It's a Game-Changer

- Mantra: A Quantitative Look at the Psychology and Actual Impact

- Nasdaq Index: Performance, Key Drivers, and Future Outlook

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)

- solar incentives (3)