Bitcoin's Breakout: What This Surge Really Means for the Future of Finance

Of course. Here is the feature article, written in the persona of Dr. Aris Thorne.

*

Bitcoin's Silent Revolution: Why This Rally Is Different and What It Means for Our Future

Every time the `bitcoin price` soars, the world divides into two camps. You have the skeptics, who see a re-run of every past bubble, a digital tulip mania fueled by pure speculation. And then you have the believers, the ones who have been quietly building and holding for years. But this time, as Bitcoin knocks on the door of its all-time high, I’m seeing something new emerge—a third group. The curious. The institutional investors. The everyday people who are starting to ask a different question: What if Bitcoin isn't just an asset? What if it's becoming a fundamental piece of our future economic infrastructure?

For years, the conversation has been trapped in a dizzying loop of price charts and get-rich-quick stories. We’ve all seen the headlines. But to focus only on the `bitcoin price today` is like staring at the tip of a rocket and ignoring the massive engine propelling it skyward. What’s happening now isn't just another rally. I believe we're witnessing a profound psychological and technological shift—a graduation. Bitcoin is moving from the world’s most volatile speculative bet to its newest safe-haven asset.

When I saw the data showing Bitcoin’s performance during the recent market shocks—the way it held its ground while traditional markets like the `Dow` faltered—I honestly just sat back in my chair, speechless. This is the kind of breakthrough that reminds me why I got into this field in the first place. This is the theory playing out in real time, and it’s a beautiful thing to watch.

The Great Uncoupling: From Speculation to Sanctuary

Let’s talk about that term: "safe-haven asset." It's a term that's being used more and more, especially as Bitcoin rallies to within 1% of all-time high, gaining safe-haven status during shutdown. In simpler terms, it’s where people put their money when they lose faith in everything else. For centuries, that asset has been gold. When governments print money endlessly, when inflation eats away at savings, when geopolitical instability spooks the markets, people flock to the stability of the `gold price`. Gold is trusted because it's scarce, it's durable, and it exists outside the control of any single government or central bank.

Sound familiar?

What we’re seeing now is the digital equivalent of that flight to safety. Bitcoin is beginning to uncouple itself from the high-risk "tech stock" category—where it was often lumped in with things like `Tesla stock`—and is starting to behave more like digital gold. It possesses verifiable scarcity, with its hard cap of 21 million coins. It's incredibly durable, secured by the most powerful computer network in human history. And most importantly, it is decentralized. No CEO can dilute its value. No government can seize it with a keystroke.

This isn't just a metaphor; it's a new financial reality taking shape before our eyes. Think of the global financial system as a vast ocean. For decades, we've all been sailing on ships built by central banks and governments. But now, the seas are getting rougher, and people are starting to notice a new kind of vessel on the water. This vessel is Bitcoin—a global, self-sovereign life raft. It doesn’t matter where you are in the world; you can access it. It doesn’t care about your government's monetary policy. It just is. Is it still volatile? Of course. But are people starting to see it as a hedge against the systemic risks of the old world? The data says yes.

More Than a Price Tag: The Network Becomes the Economy

If the safe-haven narrative is the engine, then the maturation of the entire ecosystem is the rocket fuel. This is the part of the story that most financial news completely misses. They see the `bitcoin stock price`, but they don't see the sprawling, vibrant digital city being built on its foundation.

The approval of a `Bitcoin ETF` wasn't just a technicality; it was a bridge. It connected the old world of finance—with its pension funds and retirement accounts—to this new digital continent. It gave legitimacy and accessibility to millions who were curious but intimidated. Suddenly, buying Bitcoin became as easy as buying a share of stock. This is a paradigm shift, and its effects are only just beginning to ripple through the system.

And it’s not just about access. The technology itself is evolving at a blistering pace. Look at the innovation happening on layers above Bitcoin, designed to make it faster and cheaper for everyday transactions. This is where the whole ecosystem, including other major projects like `Ethereum` or even `XRP`, comes into play, each experimenting with different trade-offs. The speed of development is just staggering—it means the gap between the financial system we have today and the one we’re building for tomorrow is closing faster than we can even comprehend.

This all reminds me of the early 1990s and the birth of the public internet. Back then, critics dismissed it as a fad for academics and nerds. They saw slow dial-up modems and clunky websites. They didn't see the underlying protocol, TCP/IP, that was about to rewire society. Today, people see a volatile `bitcoin chart`. They don't see the protocol underneath—a global, immutable ledger that is poised to do for value what the internet did for information.

Of course, with great power comes great responsibility. The conversation around the energy consumption of `bitcoin mining` is a critical one. But I see this not as a fatal flaw, but as one of the greatest drivers of energy innovation we've ever seen. Miners are incentivized to find the cheapest power on earth, which is increasingly renewable energy that would otherwise be wasted. We’re already seeing `bitcoin mining` operations stabilize power grids and fund new green energy projects. What if we’re building a new financial system that also helps us build a more sustainable energy system? What a profoundly exciting possibility.

We're Charting a New Map

So, where do we go from here? While many believe Bitcoin's Key Trends Suggest BTC Price Still Has Plenty of Room to Run, the numbers on the screen are just a reflection of a much deeper human story. It's a story about trust, about control, and about what we choose to value in an increasingly digital and uncertain world. The `price of bitcoin` isn’t the destination; it’s a signpost. It’s a measure of the world’s growing confidence in a new kind of system—one that is open, borderless, and belongs to everyone.

We are at an inflection point. This isn't about day trading or trying to time the market. It's about understanding that the very architecture of money and value is being rebuilt from the ground up. You have a chance not just to watch it happen, but to be a part of it. This is about looking past the noise and seeing the blueprint for a more decentralized, resilient, and equitable future. And that, to me, is the most valuable asset of all.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

-

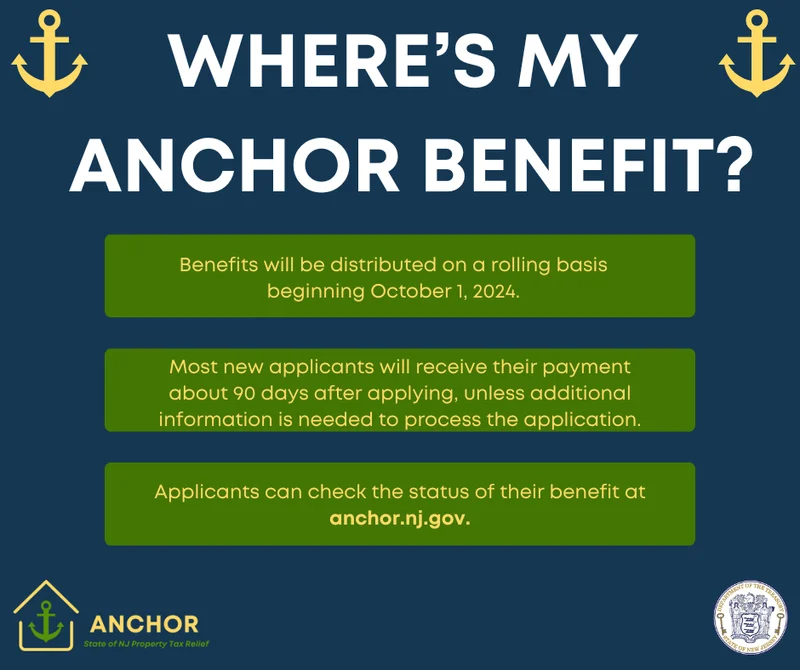

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

- Search

- Recently Published

-

- Scott Bessent's 'Price Floor' Plan for China: What We Know and Why It's Pure Insanity

- Salesforce (CRM) Stock Surges on $60B Revenue Target: What the Forecast Means and If the Numbers Add Up

- The SMR Stock Gold Rush: What's Behind the Army Deal Hype and Is It All Just Hot Air?

- United Airlines Stock Drops on Mixed Q3 Results: Analyzing the Earnings Beat and Revenue Shortfall

- COOT Stock's Breakthrough Surge: Why It's Happening and What It Means for Our Future

- Tech Giants' $40B Aligned Data Centers Acquisition: Why This Is a Turning Point for AI's Future

- Turkey's "Steel Dome" Defense System: What It Is and Why It's a Game-Changer

- Mantra: A Quantitative Look at the Psychology and Actual Impact

- Nasdaq Index: Performance, Key Drivers, and Future Outlook

- Robert Herjavec's Million-Dollar Investment Strategy: The Surprising Answer and the Future-Proof Logic Behind It

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)