The 2026 Tax Brackets Are Official: Here's What They're Not Telling You

So the IRS just dropped the 2026 tax numbers, and the official narrative is that we should all be popping cheap champagne. They’ve graciously decided to let us keep a few more of our own inflation-ravaged dollars.

Give me a break.

This annual ritual is a masterclass in political theater. They call it "tax relief," but let's be real: it's the bare-minimum maintenance required to stop the engine from seizing. When your paycheck buys less gas and fewer groceries, letting you keep a sliver more of it isn't a gift. It's a calculated adjustment to prevent what they call "bracket creep," which is a sterile, bureaucratic term for the government quietly getting a raise every time the price of milk goes up.

This whole song and dance is brought to you by the "One Big, Beautiful Bill," or OBBB. You can't make this stuff up. It sounds less like landmark tax legislation and more like something a washed-up real estate mogul would name his new golf course. And its main achievement? Making most of the 2017 tax cuts permanent, ensuring the tax code remains a byzantine mess for another generation.

They want you to get excited about the standard deduction going up to $16,100 for single filers. Wow. That’s a whole $350 more than 2025. Don’t spend it all in one place.

The Shell Game of 'Relief'

Look, I get it. The 2026 Tax Brackets are getting wider. The 37% bracket won't hit single filers until their income is over $640,600. This is presented as a win, a subtle tax cut for everyone. But it’s an illusion. It’s like a casino announcing it’s adjusting the slot machines to account for the fact that the tokens are now physically smaller. You’re not winning more; you’re just not losing as much to a system that’s already rigged against you.

The government gets to use the Chained CPI to calculate these adjustments, which is a metric that consistently runs lower than the regular CPI that reflects what you're actually paying for things. So, they get to measure inflation with a yardstick that’s missing a few inches and then act like they’re doing you a favor. How is this anything other than a slow-motion swindle? Why are we supposed to be grateful for a partial refund on a hidden tax we never agreed to pay in the first place?

And the complexity is the point. You have the standard deduction, the Alternative Minimum Tax, the Qualified Business Income deduction, phaseouts that go up and phaseouts that come down... it's a labyrinth designed to make you give up and just... pay. It’s job security for accountants and a massive headache for everyone else. Offcourse, that’s the entire point.

I once tried to figure out if I could use my Health FSA to buy one of those fancy smart thermometers. I spent 45 minutes reading IRS publications, got three different answers, and ended up just buying it on Amazon and eating the cost. That’s the tax code in a nutshell: a system so convoluted that it’s easier to just lose money than to try and follow the rules.

Crumbs for Us, a Feast for Them

When you dig into the details, the real priorities become painfully clear. Sure, there are some modest bumps that will help regular people. The adoption credit is up, which is genuinely good. Commuter and parking benefits are up to $340 a month. That’s nice, I guess, if you’re one of the few people still commuting five days a week to an office you hate.

Then you see the other numbers. The estate tax exclusion—the amount of money you can leave to your heirs tax-free—is being jacked up to $15 million. That’s not a typo. Fifteen. Million. Dollars.

Who, exactly, is this for? Is it for the person working two jobs to make rent? Is it for the family trying to figure out how to pay for college? Or is it for the handful of dynastic families who want to ensure their great-great-grandchildren never have to experience the indignity of a 9-to-5 job? We all know the answer.

Then there’s the employer childcare credit, which is expanding to $500,000. This is a great idea. No, "great" doesn't cover it—this is a PR masterpiece. It sounds fantastic, but it puts the entire burden of action on your company. It relies on your boss deciding to navigate the IRS paperwork and offer a benefit instead of just pocketing the cash. How many will actually do it? We’re supposed to hope for corporate benevolence to solve a systemic crisis.

Meanwhile, the personal exemption is still gone. Permanently. And for some higher-income earners, the changes to the AMT phaseouts actually represent a stealth tax increase. It’s a classic move: give with one hand, take with the other, and make sure the whole process is so confusing that no one can follow the money. Then again, maybe I'm the crazy one for expecting it to make any sense at all.

So We're Supposed to Be Grateful?

Don't fall for it. This isn't a tax cut. It isn't "relief." It's a cost-of-living adjustment for a tax system that remains fundamentally broken. It’s the government putting a fresh coat of paint on a condemned building and hoping nobody looks at the crumbling foundation. The core of the system—overly complex, tilted toward the ultra-wealthy, and designed to extract wealth—is untouched. These annual tweaks are just noise. They're a distraction to keep us focused on the pennies they're "giving back" while they continue to haul away the dollars.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

-

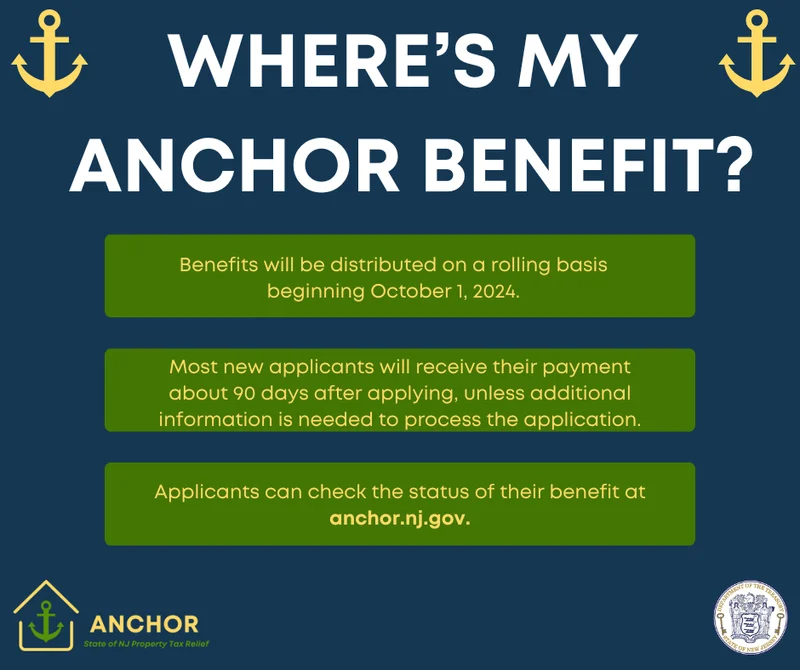

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

- Search

- Recently Published

-

- Scott Bessent's 'Price Floor' Plan for China: What We Know and Why It's Pure Insanity

- Salesforce (CRM) Stock Surges on $60B Revenue Target: What the Forecast Means and If the Numbers Add Up

- The SMR Stock Gold Rush: What's Behind the Army Deal Hype and Is It All Just Hot Air?

- United Airlines Stock Drops on Mixed Q3 Results: Analyzing the Earnings Beat and Revenue Shortfall

- COOT Stock's Breakthrough Surge: Why It's Happening and What It Means for Our Future

- Tech Giants' $40B Aligned Data Centers Acquisition: Why This Is a Turning Point for AI's Future

- Turkey's "Steel Dome" Defense System: What It Is and Why It's a Game-Changer

- Mantra: A Quantitative Look at the Psychology and Actual Impact

- Nasdaq Index: Performance, Key Drivers, and Future Outlook

- Robert Herjavec's Million-Dollar Investment Strategy: The Surprising Answer and the Future-Proof Logic Behind It

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)