Opening a Bank Account: What 'Free' Offers Really Mean & How to Just Get It Done Online

Let's get one thing straight: that money you think is sitting safely in your bank account? It isn't really yours.

You have conditional access. A privilege. You're renting space on a server, and the landlord—a delightful partnership of your bank and the government—can change the locks whenever they feel like it. And boy, are they feeling like it.

I stumbled across this story out of Vietnam that should be a five-alarm fire for anyone who still believes in the fantasy of financial autonomy. The government there just nuked 86 million bank accounts. Poof. Gone. Why? Because the owners didn't comply with a new facial biometric mandate. Some poor schmuck, a former contractor, now has to fly back into the country just to keep his HSBC account from being liquidated.

Think about that. You have to physically present your face, like some sort of parole check-in, to access your own damn money. Bitcoin guys are having a field day with this, screaming "This is why we Bitcoin!" and honestly... for once, they might have a point. As one outlet put it, this is Why we Bitcoin — Vietnam closes 86M bank accounts that fail biometrics. This ain't some abstract threat. It's happening right now.

The Digital Mugging You Signed Up For

Of course, it's not just governments getting in on the action. The private sector is just as eager to prove how little control you have. Every day there's a new horror story. This week's special is a fake VPN and streaming app called "Mobdro Pro" that installs a nasty little Trojan named Klopatra.

It's brilliant, in a sociopathic sort of way. Lure people in with the promise of free TV—something we all crave because we're being bled dry by a dozen different streaming subscriptions—and then just... take everything. The malware gives attackers full remote control of your phone. They can watch you type in your banking password and then help themselves. It's like handing a burglar the keys to your house, your car, and your safe, all because they offered you a free pizza.

This is the bargain we've made. We trade real security for the feeling of security. We download apps with a million five-star reviews from bots, grant them permissions to access everything but our soul (and they're probably working on that), and then act surprised when it all goes sideways. The security researchers say things like, "Klopatra’s effectiveness lies in a carefully orchestrated infection chain."

Let me translate that from corporate-speak: "They tricked you, and you fell for it."

The whole system is designed to lull you into a state of complacency. Open a bank account online! It’s easy! Get a high-yield savings account! Look at this 5.00% APY from Varo Money! We're bombarded with these ads for a frictionless financial fantasy. Meanwhile, the actual friction is being saved for when you try to use your money in a way they don't like.

The All-Seeing Teller

You think this is just a problem for people downloading sketchy apps or living under authoritarian regimes? Cute.

Try walking into your friendly local Chase or Bank of America branch and asking to withdraw $10,001 in cash. Go ahead, I'll wait. You might be surprised to learn This Is What Really Happens When You Withdraw $10,000 From Your Bank Account. Before the ink is dry on the withdrawal slip, that teller is filling out a Currency Transaction Report (CTR) and sending it straight to a little bureau of the Treasury called FinCEN.

The official reason is to "prevent money laundering" and other financial crimes. A noble cause, I guess. But the practical effect is that you, a law-abiding citizen, are now on a list. Your perfectly legal transaction is now a data point for the IRS and god knows who else to scrutinize. You have to justify taking out your own money.

And don't even think about getting clever. Withdrawing $9,000 today and $9,000 next week? That's called "structuring," and it'll get you a Suspicious Activity Report (SAR) filed so fast it'll make your head spin. You're treated as a potential criminal for trying to maintain a shred of privacy. This is a bad system. No, 'bad' doesn't even cover it—this is a fundamentally broken relationship between us and our money.

They've built a financial panopticon where every move is tracked, logged, and analyzed. They want us to `open bank account` after `bank account online`, chase `new bank account offers`, and pour our savings into these digital vaults. But the moment we want to take out a meaningful amount, the alarms go off. It’s a one-way street paved with good intentions and ending in total surveillance. And we're just supposed to be transparent and not worry about it? Give me a break.

The whole thing is a fragile, terrifying house of cards, and we're all just hoping the wind doesn't blow.

It's Their Sandbox, and They Can Take the Toys Home

Look, I get it. We need rules. We need to stop criminals. But when does "security" become a euphemism for "control"? We're being pushed into a system where our access to our own lives is conditional. Fail to provide your face scan? Account closed. Download the wrong app? Bank account drained. Withdraw "too much" cash? You're on a watchlist. It's a digital leash, and it's getting shorter every single day. The promise of an easy, high-yield `capital one bank account` is just the cheese in the trap. The real product isn't the interest rate; it's our compliance. And offcourse, we're giving it away for free.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

-

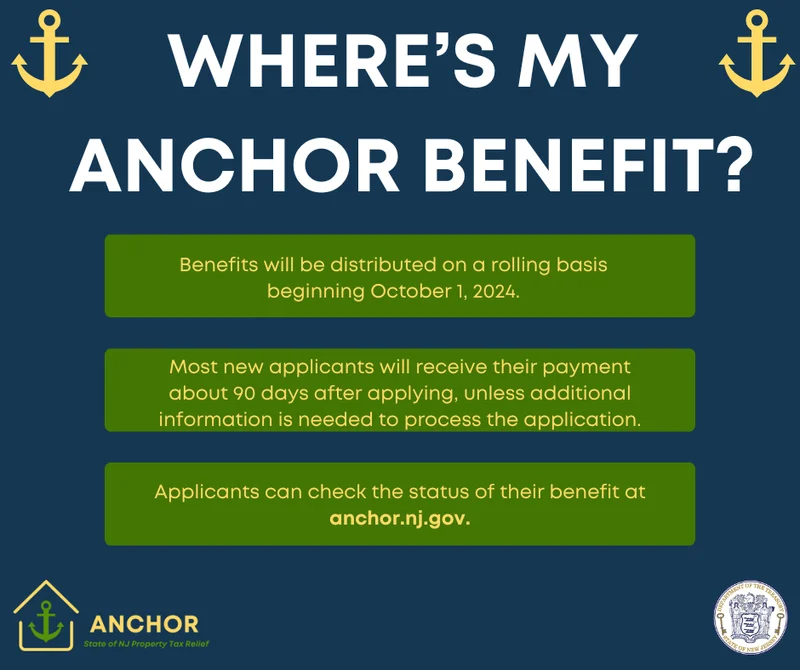

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

- Search

- Recently Published

-

- Scott Bessent's 'Price Floor' Plan for China: What We Know and Why It's Pure Insanity

- Salesforce (CRM) Stock Surges on $60B Revenue Target: What the Forecast Means and If the Numbers Add Up

- The SMR Stock Gold Rush: What's Behind the Army Deal Hype and Is It All Just Hot Air?

- United Airlines Stock Drops on Mixed Q3 Results: Analyzing the Earnings Beat and Revenue Shortfall

- COOT Stock's Breakthrough Surge: Why It's Happening and What It Means for Our Future

- Tech Giants' $40B Aligned Data Centers Acquisition: Why This Is a Turning Point for AI's Future

- Turkey's "Steel Dome" Defense System: What It Is and Why It's a Game-Changer

- Mantra: A Quantitative Look at the Psychology and Actual Impact

- Nasdaq Index: Performance, Key Drivers, and Future Outlook

- Robert Herjavec's Million-Dollar Investment Strategy: The Surprising Answer and the Future-Proof Logic Behind It

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)