Plasma Integrates with Chainlink: What the Data Reveals About Its Price Impact

Plasma vs. Plasma: One Word, Two Universes of Risk and Reality

The word "plasma" crossed my desk twice this week, and the discrepancy couldn't be more illustrative of the markets today. In one instance, it described a state of matter—superheated gas inside a 40-year-old fusion reactor that just finished its operational life. In the other, it described a brand-new Layer 1 blockchain whose token shed a third of its value in its first week.

One is the product of a half-century of international scientific collaboration, a tangible machine of tungsten and beryllium being painstakingly disassembled by robots over the next 15 years. The other is a digital construct that acquired a multi-billion dollar valuation in days and is now navigating the brutal, immediate gravity of market sentiment.

Both are fascinating. Both are ambitious. But they represent two fundamentally different philosophies of building, of value, and of time itself.

The 40-Year Plasma

Let’s start with the physical. The Joint European Torus, or JET, was a marvel of engineering. For four decades, it was the world’s leading fusion research facility, a massive tokamak that, for brief, record-breaking moments, contained the power of a star. In December 2023, it was shut down. Its final act wasn't a quiet power-down but a series of deliberate, controlled self-sabotage experiments—intentionally disrupting the plasma to see how the machine’s inner wall would melt and react.

Think about that. The project was so scientifically rigorous that even its death was a data-gathering exercise for the next generation of machines. Now, the UK Atomic Energy Authority is using remote-controlled robotics to carefully remove 66 sample tiles from its core. As one report noted, these are the First JET tiles removed, studied for impact of high-powered plasmas. This isn't a cleanup; it's a forensic autopsy. They’re studying how decades of containing miniature suns has affected the materials, information that will inform the decommissioning plan (a process expected to last until 2040) and the design of future reactors like ITER.

This is the world of atoms, of long-term capital, of projects whose timelines are measured in multiple careers. The goal wasn't a quick exit or a parabolic price chart; it was the slow, methodical pursuit of a world-changing technology. I've looked at hundreds of project roadmaps in my time, and a 15-year plan just for decommissioning is a level of foresight that's almost alien in today's financial markets. It’s a testament to building something so substantial that even taking it apart is a monumental act of engineering.

This project is like building a cathedral. It’s a multi-generational effort with an unshakeable foundation, where every stone is laid with purpose and the final structure is meant to outlast its creators. The value isn't in daily price fluctuations, but in the accumulated knowledge and the slow, steady progress toward an almost unimaginable goal.

The 7-Day Plasma

Then we have the other plasma. Plasma, the Layer 1 blockchain, launched just last week. It arrived with a clear, modern playbook: a focus on the booming stablecoin sector (a market now over $300 billion), a native token (XPL), and immediate, high-profile integrations. In a move that signaled its ambitions, Plasma Joins Chainlink SCALE, Integrates Aave, tapping into the DeFi lending giant with nearly $46 billion in Total Value Locked (TVL).

These are smart, strategic moves designed to bootstrap an ecosystem and signal legitimacy. By partnering with the biggest names in the space, a new project can borrow credibility and attract the mercenary capital that floods into any new, promising ecosystem. And for a moment, it worked. Plasma’s own TVL quickly surpassed $5.6 billion, and its token, XPL, debuted at a staggering $10 billion valuation (a figure that already bakes in immense future expectations).

But the digital world moves at a different speed. After a brief surge, XPL’s price cratered. The token has dropped about a third of its value—to be more exact, nearly 34% since going live. Rumors swirled about internal team members selling tokens, a narrative the founder, Paul Faecks, had to publicly refute by clarifying that all team allocations are locked for three years.

This is the brutal reality of the crypto market. Value is not a slow accumulation of knowledge; it’s a real-time battle between narrative, liquidity, and sentiment. A partnership announcement can send a price soaring, while a few unsubstantiated rumors can erase billions in perceived value overnight. What does a TVL of $5.6 billion truly represent if it can appear and disappear so quickly? Is it a stable foundation or a temporary hot-money hotel?

A Tale of Two Timescales

Here is the core of the issue. The crypto space has become exceptionally skilled at co-opting the language of deep science and engineering—"plasma," "fusion," "ecosystem," "protocol"—to describe what are, fundamentally, high-speed, high-risk financial instruments.

One "plasma" represents a slow, painstaking, multi-decade march toward a tangible goal. Its failures are controlled experiments, its successes are measured in joules of energy, and its legacy will be written in scientific papers and engineering blueprints. The other "plasma" represents a high-stakes, hyper-accelerated bet on a digital future. Its failures are public market routs, its successes are measured in TVL and token price, and its legacy is yet to be written.

This isn't a judgment on which is "better." Both are attempts at innovation. But we must be brutally honest about the games we are watching—and playing. One is a marathon of physics and material science. The other is a sprint of financial engineering and narrative warfare. Confusing the two is a categorical error, and a costly one at that.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

-

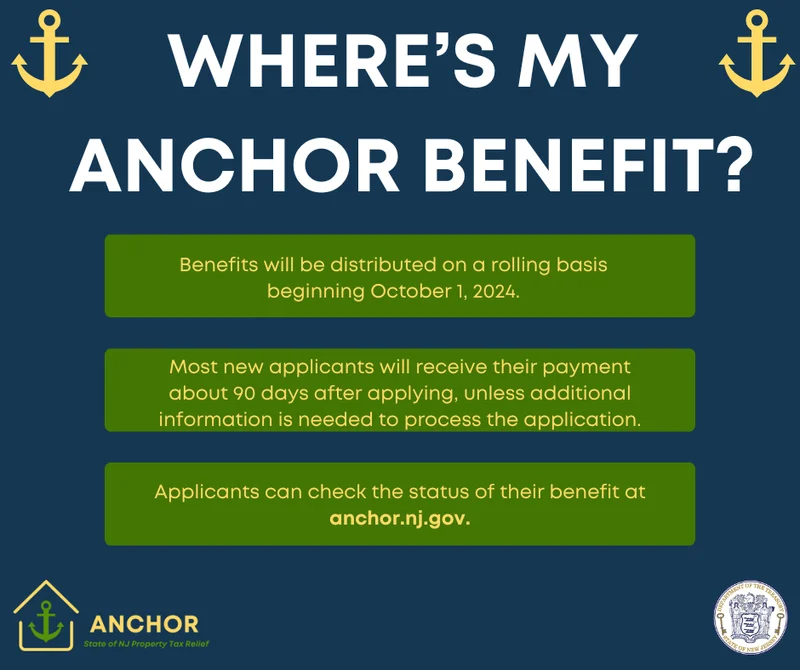

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

- Search

- Recently Published

-

- Scott Bessent's 'Price Floor' Plan for China: What We Know and Why It's Pure Insanity

- Salesforce (CRM) Stock Surges on $60B Revenue Target: What the Forecast Means and If the Numbers Add Up

- The SMR Stock Gold Rush: What's Behind the Army Deal Hype and Is It All Just Hot Air?

- United Airlines Stock Drops on Mixed Q3 Results: Analyzing the Earnings Beat and Revenue Shortfall

- COOT Stock's Breakthrough Surge: Why It's Happening and What It Means for Our Future

- Tech Giants' $40B Aligned Data Centers Acquisition: Why This Is a Turning Point for AI's Future

- Turkey's "Steel Dome" Defense System: What It Is and Why It's a Game-Changer

- Mantra: A Quantitative Look at the Psychology and Actual Impact

- Nasdaq Index: Performance, Key Drivers, and Future Outlook

- Robert Herjavec's Million-Dollar Investment Strategy: The Surprising Answer and the Future-Proof Logic Behind It

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)