John Hancock Investments: What the Numbers Reveal About Their Market Strategy

The Allure of the Familiar Signature

There's a certain gravity to a name like John Hancock. It evokes images of parchment, rebellion, and a bold signature that became a synonym for the act itself. The company that bears his name leans into this legacy, projecting an aura of stability and American fortitude. It’s a powerful marketing tool, especially in the volatile world of finance where investors are constantly searching for an anchor.

Enter the John Hancock Premium Dividend Fund (PDT). On the surface, it’s the perfect modern translation of that old-world reliability. The fund recently declared its monthly dividend of $0.0825 per share, which translates to a handsome 7.4% yield on an annualized basis. In an environment where every percentage point of return is a battle, 7.4% isn't just attractive; it's a siren's call for income-focused investors. The fund’s price is hovering near its 52-week high of $13.55, and it’s trading comfortably above both its 50-day and 200-day moving averages. The narrative writes itself: a stable fund, backed by a historic name, throwing off a steady stream of cash. It’s exactly what the branding promises. But is a high yield today a reliable indicator of total return tomorrow?

This is where the story gets interesting. The fund’s portfolio has a heavy emphasis on the utilities sector, a classic defensive play favored for its predictable cash flows and dividend payments. It's the financial equivalent of political moderation—a stabilizing force in a portfolio rebelling against market chaos. For an investor whose primary goal is to generate a consistent monthly check, this structure appears to be a dream. The numbers, at first glance, seem to support the thesis. It's doing precisely what a "premium dividend fund" is supposed to do. The question is, what isn't it doing?

A Quiet Discrepancy in the Data

As we dig deeper, a few data points emerge that complicate the simple, appealing narrative. The first is institutional ownership. My analysis shows that large investors—hedge funds, pension funds, and the like—own about 13% of the stock. Or, to be more exact, 12.98%. Now, this figure in isolation isn't necessarily a red flag, but it does make one pause. Does a sub-13% institutional stake signal a lack of conviction from the so-called "smart money," or is this simply characteristic for this particular class of closed-end fund? Without more comparative data, it’s an open question, but it’s a thread worth pulling.

The real story, however, is found not in who owns the fund, but in what the broader analytical community thinks of it. A recent report from MarketBeat, John Hancock Premium Dividend Fund (NYSE:PDT) Declares Monthly Dividend of $0.08, contained a crucial piece of context. While delivering the facts about PDT, it also noted that the fund was conspicuously absent from its list of "five stocks that top analysts are quietly whispering to their clients to buy now." In fact, the consensus rating for PDT is a simple "Hold."

And this is the part of the report that I find genuinely puzzling. A 7.4% yield isn't just noise; it's a significant return on capital. Yet, the sharpest minds on Wall Street are, in effect, shrugging their shoulders. This isn't a "Sell" rating, which would imply something is fundamentally wrong. It's a "Hold," which suggests something else entirely: opportunity cost. The fund is like a financial draft horse—strong, reliable, and capable of pulling a heavy load (the dividend), but it's not a thoroughbred expected to break away from the pack. The analysts seem to be saying the yield is fine, but you shouldn't expect much else. What are they seeing that the retail dividend-hunter, mesmerized by that 7.4% figure, might be missing?

It's a Yield, Not a Verdict

So, we're left with a classic market conundrum. Is the John Hancock Premium Dividend Fund a dream or a trap? The answer, I believe, is neither. It’s a tool, and its value depends entirely on the job you're hiring it to do. If you are an investor in or near retirement, and your sole objective is to generate a predictable income stream to cover living expenses, that 7.4% yield looks like a well-oiled machine. You are accepting a trade-off: you're likely sacrificing the potential for significant capital appreciation in exchange for that hefty monthly dividend check.

But for anyone with a longer time horizon, that "Hold" rating should be a flashing yellow light. It suggests that the total return—the dividend plus stock price appreciation—may lag other opportunities in the market. The high yield might be a form of compensation for lower growth prospects. This is the definition of a value trap: an asset that appears cheap or high-yielding on the surface but underperforms over the long run because its underlying growth is stagnant. The fund isn't broken. It's just not built for speed. The name John Hancock may promise revolutionary spirit, but the fund itself is offering something far more moderate: a predictable, but potentially uninspiring, dividend.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

-

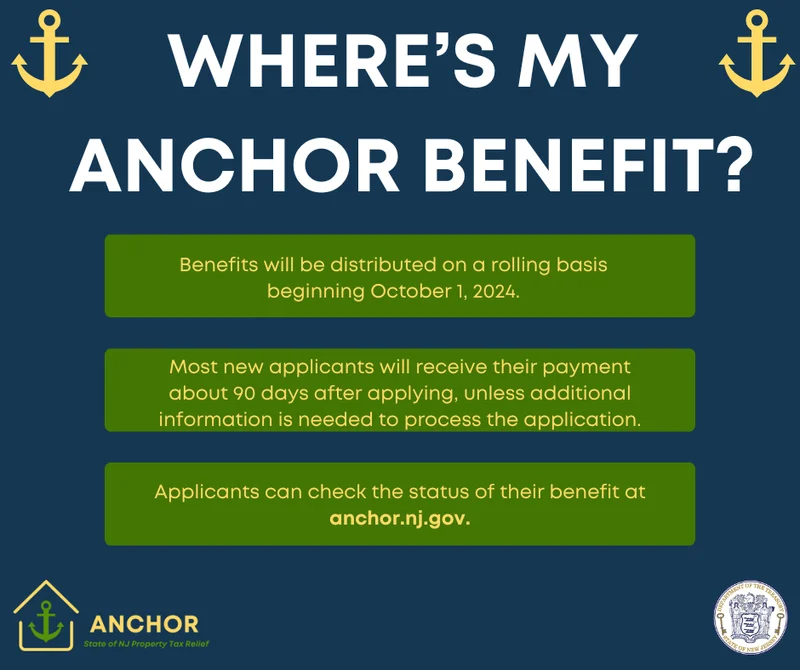

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

- Search

- Recently Published

-

- The Fight for Solar Incentives: What's Really at Stake and Why It's Our Biggest Opportunity Yet

- Scott Bessent's 'Price Floor' Plan for China: What We Know and Why It's Pure Insanity

- Salesforce (CRM) Stock Surges on $60B Revenue Target: What the Forecast Means and If the Numbers Add Up

- The SMR Stock Gold Rush: What's Behind the Army Deal Hype and Is It All Just Hot Air?

- United Airlines Stock Drops on Mixed Q3 Results: Analyzing the Earnings Beat and Revenue Shortfall

- COOT Stock's Breakthrough Surge: Why It's Happening and What It Means for Our Future

- Tech Giants' $40B Aligned Data Centers Acquisition: Why This Is a Turning Point for AI's Future

- Turkey's "Steel Dome" Defense System: What It Is and Why It's a Game-Changer

- Mantra: A Quantitative Look at the Psychology and Actual Impact

- Nasdaq Index: Performance, Key Drivers, and Future Outlook

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)

- solar incentives (3)