Bitcoin's October Surge: The Data Behind the Rally and What's Next

The price action is impossible to ignore. As of this morning, October 1st, 2025, Bitcoin has cleared $116,000, touching intraday highs above $117,400. The immediate narrative, amplified across every financial news terminal, is straightforward: the temporary U.S. government shutdown has weakened the dollar, sending capital scrambling for non-sovereign safe havens. Gold hitting a fresh all-time high above $3,900 an ounce certainly supports this thesis. It’s a clean, simple story of cause and effect.

And it’s probably incomplete.

While the political theater in Washington provides a convenient catalyst, my analysis suggests it's more of an accelerant than a root cause. The groundwork for this move was laid weeks ago, visible not in congressional debates but in the cold, hard data of institutional capital flows and seasonal probabilities. The shutdown is the headline; the real story is about positioning.

The data driving the popular narrative is clear enough. With Congress failing to pass a funding bill, key economic data releases—the September jobs report, weekly jobless claims, upcoming inflation figures—are now delayed. This injects a significant dose of uncertainty into markets and complicates the Federal Reserve’s policy decisions. In response, the dollar has softened, and assets outside the traditional system are catching a bid. But correlation is not causation. To attribute a 4% intraday surge in Bitcoin entirely to a widely anticipated, and likely temporary, political impasse is to ignore a far more powerful confluence of factors.

The first is seasonality. September has a reputation for being a difficult month for crypto assets, but 2025 was an outlier. Bitcoin closed the month with a gain of about 5%—to be more exact, final data from several sources places the monthly performance closer to a 6% gain. This is significant. In years where Bitcoin has managed to close September in the green (instances in 2015, 2016, 2023, and 2024), the fourth quarter has historically delivered outsized returns, with rallies averaging over 50%. The market has a memory, and participants are positioning for what is colloquially known as "Uptober." The expectation of a strong Q4 was already being priced in.

Why the Shutdown Was the Excuse, Not the Reason

The Signal Was in the Flows, Not the News

This brings us to the more compelling evidence: institutional fund flows. In the final two days of September, just before the shutdown narrative took hold, spot Bitcoin ETFs saw a net inflow of $950 million. This wasn't just a minor uptick; it was a complete reversal of the $900 million in outflows recorded the previous week. I've looked at hundreds of capital flow reports, and a reversal of this magnitude, executed just 48 hours before the start of a historically bullish quarter, doesn't strike me as a reaction to breaking political news. It looks like premeditated positioning.

This is the kind of deliberate, large-scale accumulation that precedes a major move. The anecdotal evidence, such as BlackRock’s reported transfer of over $130 million in BTC to Coinbase, further supports this view. While the specific intent of any single transfer is opaque, the aggregate pattern points toward institutions front-running the seasonal trend, using the late-September dip as an accumulation opportunity. The government shutdown simply provided the perfect narrative cover and the final push needed to break key technical levels.

From a technical standpoint, the market structure confirms this shift in control. The price has decisively reclaimed the $112,000 level, which also corresponds with the 50-period exponential moving average. This zone had been acting as local resistance, and breaking above it has opened a path toward the September highs around $117,000, a level being tested as I write. The next significant hurdles are the psychological barrier at $120,000 and the multi-month consolidation ceiling near $124,000. On the downside, a substantial block of support appears to be layered between $100,000 (a key psychological level and 50% Fibonacci retracement) and $108,000. The structure suggests that corrections are more likely to be viewed as buying opportunities than the start of a reversal.

Of course, a critical eye must be applied to the very models suggesting this outcome. The reliance on seasonality is a popular analytical shortcut, but it has its flaws. The claim that a green September has always led to a green October is based on a very small sample size. Relying on such a limited historical data set as a deterministic predictor is statistically questionable. A handful of occurrences does not constitute an immutable law of market physics. However, it doesn't have to be a scientific law to be effective. If enough market participants believe in the "Uptober" phenomenon and position accordingly—as the ETF flow data suggests they have—it becomes a self-fulfilling prophecy.

The current environment is a textbook example. The macro backdrop is undeniably supportive, with the market now pricing in a 99% probability of another Fed rate cut this month. Weak private payrolls data (showing the largest decline in 2.5 years) only reinforces this expectation. This monetary easing, combined with the dollar weakness from the shutdown, creates an ideal environment for scarce assets. But the timing and velocity of this specific rally feel less like a spontaneous reaction and more like the scheduled departure of a train that institutions had already boarded. The shutdown was merely the conductor blowing the final whistle.

---

The Illusion of Spontaneity

The market abhors a vacuum, and it loves a simple story. Attributing Bitcoin’s current rally to the chaos in Washington is an easy, digestible narrative. The reality, however, is far more methodical. The surge we're witnessing today wasn't born from a midnight congressional failure; it was engineered in the final days of September through nearly a billion dollars in institutional inflows. These participants weren't reacting to headlines. They were acting on a clear, data-driven seasonal probability. The shutdown isn't the reason for the rally; it was simply the convenient and perfectly timed catalyst that allowed a pre-loaded trade to express itself with maximum velocity. The chaos is the noise; the signal was in the order books all along.

Reference article source:

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

-

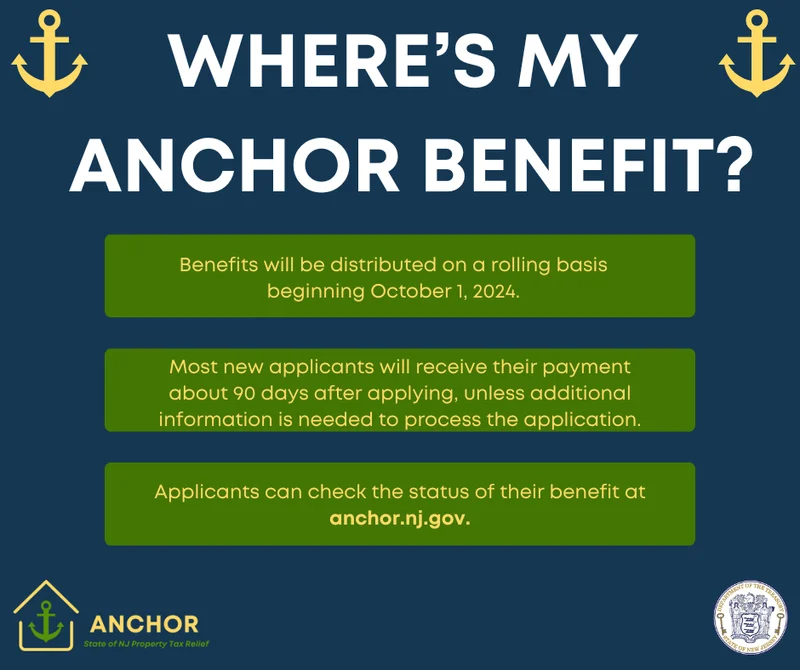

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

- Search

- Recently Published

-

- Scott Bessent's 'Price Floor' Plan for China: What We Know and Why It's Pure Insanity

- Salesforce (CRM) Stock Surges on $60B Revenue Target: What the Forecast Means and If the Numbers Add Up

- The SMR Stock Gold Rush: What's Behind the Army Deal Hype and Is It All Just Hot Air?

- United Airlines Stock Drops on Mixed Q3 Results: Analyzing the Earnings Beat and Revenue Shortfall

- COOT Stock's Breakthrough Surge: Why It's Happening and What It Means for Our Future

- Tech Giants' $40B Aligned Data Centers Acquisition: Why This Is a Turning Point for AI's Future

- Turkey's "Steel Dome" Defense System: What It Is and Why It's a Game-Changer

- Mantra: A Quantitative Look at the Psychology and Actual Impact

- Nasdaq Index: Performance, Key Drivers, and Future Outlook

- Robert Herjavec's Million-Dollar Investment Strategy: The Surprising Answer and the Future-Proof Logic Behind It

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)