Richtech Robotics (RR) Stock's 2025 Rally Begins: What's Behind the Surge and Why the Community is So Excited

I’ve seen a lot of technological demos in my time. Sleek presentations in sterile labs, promising a future that always seems to be just five years away. But something different happened when I saw the footage of ADAM, a humanoid robot from a company called Richtech Robotics, shaking up “cosmic cocktails” for the U.S. Space Force. There it was, under the lights of a gala, not in a lab—a machine with articulated fingers and an AI brain, performing a task of service and flair. This is the kind of breakthrough that reminds me why I got into this field in the first place.

This isn’t just a story about a cool robot. It’s about a signal, a tremor in the market that tells us a much larger shift is underway. That tremor is the rr stock price, which has exploded by over 700% in the last year, turning a little-known Las Vegas startup into a billion-dollar story. For years, we’ve talked about the coming age of automation. We’ve imagined a world where robots would assist us in our daily lives. What the Richtech Robotics (RR) Stock Skyrockets Amid Big Deals and Short Seller Showdown tells us is that this future isn't just coming anymore. It’s here, and it’s arriving in the most chaotic, controversial, and utterly human way imaginable.

The Friction of a Future Arriving

At the heart of Richtech’s sudden ascent are two deals that should make everyone sit up and pay attention. The company signed a Master Services Agreement with one of the largest U.S. auto dealership chains, reported to be AutoNation, to deploy its “Titan” robots to ferry parts around service bays. It also inked a two-year deal with a “leading global retailer,” which all signs point to being Walmart, the biggest retailer on the planet.

Let’s be clear about what this means. This isn’t a one-off sale of a piece of hardware. Richtech is built on a “Robots-as-a-Service” (RaaS) model. It's like the transition we saw from buying software on a CD to subscribing to services in the cloud—it fundamentally changes the economic fabric. Instead of a capital expense, automation becomes an operational utility, like electricity. Can you imagine the implications? When a company like Walmart starts integrating robotic services, it’s not just an experiment; it’s a data point that suggests a new economic reality is taking shape. It’s a quiet declaration that the efficiency, reliability, and novelty of robotic labor have reached a tipping point.

But here’s the thing about paradigm shifts: they are never smooth. They are messy, loud, and contested every step of the way. Just as Richtech’s star was rising, an activist short-seller, Capybara Research, dropped a bombshell report, accusing the company of everything from fraud to rebranding off-the-shelf Chinese robots and, most critically, of wildly overstating its partnership with Walmart. The report called the stock “uninvestable.”

And this is where the story gets truly interesting. When I hear a short-seller call a company at the bleeding edge of a paradigm shift “uninvestable,” what I really hear is the sound of an old model breaking. It’s the cry of an immune system attacking a new, foreign, but potentially vital organ. This is the friction. This is the heat generated when the future grinds against the present.

Navigating the Noise of Innovation

The battleground for Richtech is now one of credibility. The bears point to the company’s tiny revenues—just over $1 million last quarter against a $4 million loss—the COO selling some of his shares, and a recent shelf registration filing. That last one, the shelf registration—in simple terms, it's like getting pre-approval for a loan, giving the company the flexibility to raise money quickly if a massive growth opportunity suddenly appears. To skeptics, it’s a red flag for dilution. To an optimist, it’s a war chest for a revolution.

You have this incredible forward momentum from real-world contracts and tangible robots serving real people clashing with the immense gravitational pull of market skepticism and it creates this supercharged, volatile environment where the future is literally being forged in real-time. This isn’t a clean, predictable process. It’s a brawl.

This reminds me of the early days of the personal computer or the internet. Every great leap forward was met with a chorus of doubters and accusations of fraud, hype, and unsustainability. People called the automobile a noisy, dangerous fad that would never replace the horse. The noise is part of the process. It’s the static that fills the air just before the signal becomes clear.

Of course, this doesn't absolve a young company of its responsibilities. In this new world, transparency isn't just good practice; it's a survival mechanism. Richtech must prove its partnerships are as substantive as they claim and that its technology is as proprietary as it seems. The burden of proof is, and should be, on the innovator. But for us, the observers, the key is to not get lost in the noise but to listen for the underlying signal. The signal isn't about one company's quarterly earnings or its daily stock price. The signal is that robots are leaving the factory floor and entering our world—our stores, our cafes, our service centers. And that changes everything.

The Messy, Beautiful Birth of Tomorrow

So, what do we make of all this? Do we listen to the short-sellers ringing the alarm bells, or do we look at a robot serving a cocktail and see the beginning of something profound? I believe we have to do both, but we must understand what we are seeing. The chaos surrounding Richtech Robotics isn't a sign of failure. It's the sign of birth. This is what it looks like when an industry is being born, kicking and screaming its way into existence. The debate, the volatility, the high-stakes battle between belief and skepticism—it's all part of the beautiful, messy, and undeniable process of the future arriving. Don't look away. You’re watching tomorrow being built today.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

-

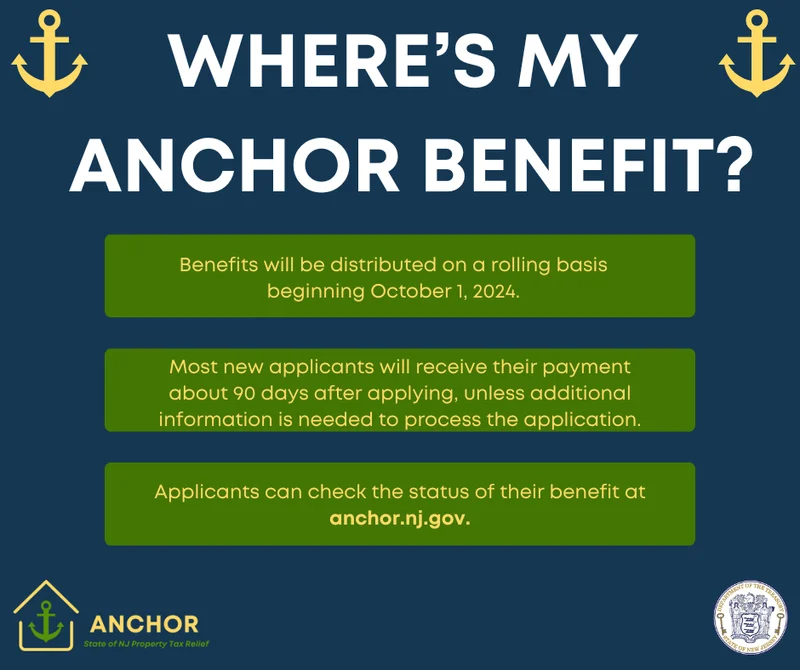

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

- Search

- Recently Published

-

- Scott Bessent's 'Price Floor' Plan for China: What We Know and Why It's Pure Insanity

- Salesforce (CRM) Stock Surges on $60B Revenue Target: What the Forecast Means and If the Numbers Add Up

- The SMR Stock Gold Rush: What's Behind the Army Deal Hype and Is It All Just Hot Air?

- United Airlines Stock Drops on Mixed Q3 Results: Analyzing the Earnings Beat and Revenue Shortfall

- COOT Stock's Breakthrough Surge: Why It's Happening and What It Means for Our Future

- Tech Giants' $40B Aligned Data Centers Acquisition: Why This Is a Turning Point for AI's Future

- Turkey's "Steel Dome" Defense System: What It Is and Why It's a Game-Changer

- Mantra: A Quantitative Look at the Psychology and Actual Impact

- Nasdaq Index: Performance, Key Drivers, and Future Outlook

- Robert Herjavec's Million-Dollar Investment Strategy: The Surprising Answer and the Future-Proof Logic Behind It

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)