POET Technologies Secures $75M for AI: What This Means for the Stock's Future

Generated Title: POET Technologies' $75M Bet: War Chest or Lifeline?

The stock ticker for POET Technologies lit up green on October 7th. Not just green, but the kind of incandescent, retina-searing green that signifies a sudden and violent re-evaluation by the market. Traders likely saw the headline—"$75 Million Investment"—and the subsequent stock surge of about 21%—to be more exact, 21.47% to close at $7.75—as a straightforward vote of confidence. The narrative was simple: a small-cap tech player, working on the esoteric plumbing of the AI revolution, had just landed its largest-ever investment from a single, savvy institutional player. The machine was being fueled for growth.

But when I see a deal like this, a non-brokered private placement with an anonymous counterparty, my analyst instincts override the market's euphoria. The story isn't the headline number. It never is. The real story is buried in the terms, the timing, and the immense gap between the company's public narrative and its underlying financial reality. This $75 million injection for POET isn't a victory lap. It's the ante for a high-stakes poker game the company has to win.

Dissecting the Anatomy of the Deal

Let's start with the mechanics. POET issued 13.6 million shares at US$5.50 apiece. On a day the stock closed at $7.75, that’s a significant discount. But the real tell isn't the share price; it's the sweetener attached. For every share purchased, the investor also received a warrant to buy another share at C$9.78 (roughly US$7.15 at current exchange rates) anytime over the next five years.

I've looked at hundreds of these private placement filings, and this particular structure is telling. A full warrant coverage isn't a simple bonus; it’s a carefully calibrated instrument designed to compensate for substantial risk. Think of it less as a vote of confidence and more as a risk-adjusted bet. The investor gets the immediate equity at a discount, and the warrant acts as a leveraged, long-dated call option on the company's survival and success. It’s like a lender demanding both interest and a piece of the company's future profits. This structure is common when financing entities that are promising but fundamentally unproven—companies that need capital not just to expand, but to cross the chasm from development to commercial reality.

This leads to the most obvious question: who is this single, silent investor? The press release is devoid of a name, which in itself is a critical data point. A major strategic partner like a hyperscaler or a chip giant would have been trumpeted from the rooftops. An activist fund would have filed a 13D. The silence suggests a financial player—perhaps a hedge fund or a private family office—that sees a deep value proposition but has no interest in a public-facing partnership. They're not here to co-brand; they're here for the potential multi-bagger return that justifies the risk of backing a company still described in an August 2025 analyst report, Light At The End Of AI Bottleneck: Pre-Commercial Poet Technologies Stock Buyable (POET), as "pre-commercial." What information do they have that the public market doesn't? Or is their thesis based entirely on the public data, simply interpreted with a higher risk tolerance?

The Narrative of Offense vs. the Reality of Defense

In the press release, POET Technologies Closes US$75M Investment to Accelerate AI, CEO Dr. Suresh Venkatesan deployed the kind of language you expect from a company on the offensive. He spoke of an "unprecedented opportunity" in AI and declared that POET now possesses a "war chest of over $150 million in cash and no significant debt." The phrase "war chest" conjures images of a conqueror, flush with capital, ready to go on an acquisition spree and dominate the market. The stated use of funds reinforces this: "targeted acquisitions," "scaling up R&D," and "acceleration of the light source business."

This is a powerful narrative. It’s also difficult to reconcile with the company's financial profile. Analyst ratings from sources like TipRanks paint a picture of a company with "poor financial performance" and a "negative P/E ratio." This isn't a critique; it's the mathematical reality for many development-stage tech firms. They burn cash to innovate. But you cannot simultaneously be a pre-revenue, cash-burning entity and a financial fortress with a "war chest." The two are definitionally opposed.

The $150 million figure is the result of adding this new $75 million to the existing cash on hand. It’s a bit like a family that's been living on credit cards suddenly getting a large home equity loan and calling it "savings." The cash is real, but it doesn’t change the underlying burn rate or the lack of sustained, profitable revenue. The capital isn't spoils of war; it's the fuel required to fight the war itself.

This deal feels less like loading up for a shopping spree and more like securing a critical supply line. The company's Optical Interposer platform—a novel method for integrating photonics and electronics on a single chip—is undeniably sophisticated. It promises to solve major bottlenecks in AI data centers by making optical connections cheaper, smaller, and more power-efficient. It’s the kind of technology that could be revolutionary. But "could be" is the operative phrase. The journey from a working prototype to mass production at scale is notoriously treacherous and expensive. This $75 million isn't for empire-building; it's the runway capital needed to see if the plane can actually take off before it runs out of asphalt.

A Bet on Execution, Not Arrival

Strip away the market euphoria and the corporate messaging, and what remains is the anatomy of a calculated gamble. A single, sophisticated investor has paid a discounted price for a significant stake in a company with world-changing technology that has yet to prove it can dominate a commercial market. They demanded a warrant as compensation for the immense execution risk that lies ahead.

The market celebrated on October 7th as if POET had crossed the finish line. My analysis suggests it has merely been given the resources to continue the race. This $75 million cash infusion doesn't validate the business model; it funds the attempt to prove the business model. The stock pop reflects the market's relief that the company won't face a cash crunch in the near term. It's a vote for survival, not necessarily for triumph.

The real story of POET Technologies won't be written by this financing deal. It will be written in the coming quarters, in the revenue figures, gross margins, and customer adoption rates. The investor bought a five-year option on success. Now, management has to deliver it. The cash is in the bank, but the clock is officially ticking.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

-

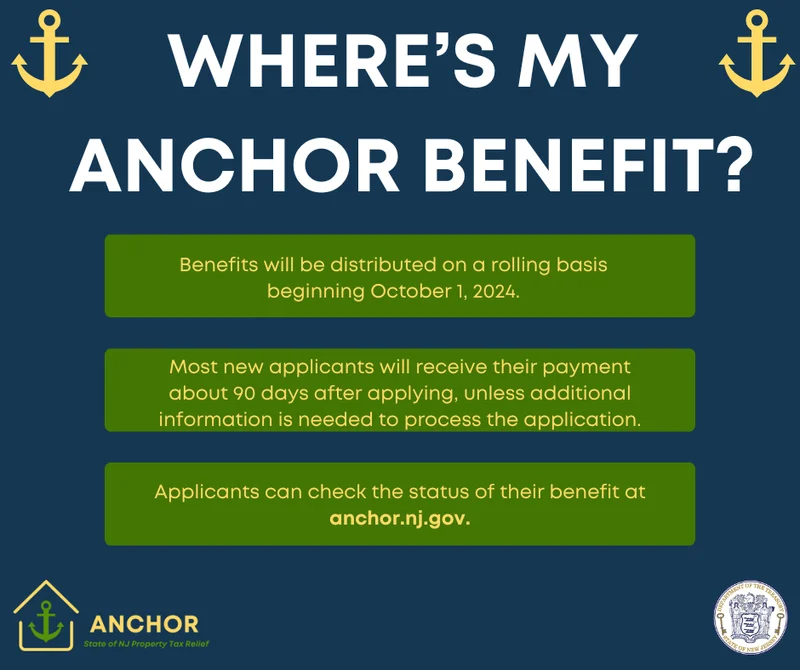

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

- Search

- Recently Published

-

- Scott Bessent's 'Price Floor' Plan for China: What We Know and Why It's Pure Insanity

- Salesforce (CRM) Stock Surges on $60B Revenue Target: What the Forecast Means and If the Numbers Add Up

- The SMR Stock Gold Rush: What's Behind the Army Deal Hype and Is It All Just Hot Air?

- United Airlines Stock Drops on Mixed Q3 Results: Analyzing the Earnings Beat and Revenue Shortfall

- COOT Stock's Breakthrough Surge: Why It's Happening and What It Means for Our Future

- Tech Giants' $40B Aligned Data Centers Acquisition: Why This Is a Turning Point for AI's Future

- Turkey's "Steel Dome" Defense System: What It Is and Why It's a Game-Changer

- Mantra: A Quantitative Look at the Psychology and Actual Impact

- Nasdaq Index: Performance, Key Drivers, and Future Outlook

- Robert Herjavec's Million-Dollar Investment Strategy: The Surprising Answer and the Future-Proof Logic Behind It

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (5)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)